Summary of California Disability and State Leave Provisions

The following briefly highlights the provisions under the various California disability and state leave programs. You may be eligible for coverage under these programs in addition to the coverage provisions under the Company’s Short-Term Disability, Salary Continuation, Family and Medical Leave (FML) and Paid Parental Leave policies. Information regarding these policies is located in the Human Resources Policies section of your Operating Company’s intranet. If you have questions about how these various leaves coordinate with Company policies, please contact your leave coordinator.

California State Disability Insurance (SDI)

California State Disability Insurance (SDI) is designed to partially replace wages you lose because of a disability that is not work-related. The definition of disability may differ from the Company’s definition of disability. Therefore, in some instances, you may qualify for benefits under State coverage but not under the Company’s coverage or vice versa.

State SDI benefits will offset the amount of income you are eligible to receive under the Company’s salary continuation policy while on short-term disability. You may be eligible to receive approximately 55% of your pre-disability weekly wages up to the state maximum weekly benefit. Although benefits may be paid by the state as well as by the Company, under no circumstances can SDI benefits plus wages (through the salary continuation policy) exceed your regular weekly wage. STD benefits provided by the Company will be reduced to coordinate with state disability benefits whether or not you have applied for such state benefits. Any overpayments made through payroll during the time you are on STD prior to receipt of a statement of any other state disability benefits will be calculated and then deducted from your pay.

For details regarding California SDI, including applying for benefits, you should contact the Employment Development Department (EDD) directly:

California Paid Family Leave (PFL)

When you are on an unpaid leave of absence to care for a seriously ill child, spouse, parent, or registered domestic partner, or to bond with a newly born or adopted minor child, PFL may provide partial income replacement benefits of approximately 55% of your lost wages. PFL offers up to six (6) weeks of benefits in a 12 month period. There is customarily a seven-day unpaid waiting period before benefits begin. However, if you’ve already fulfilled the required seven-day waiting period for SDI benefits when taking Pregnancy Disability Leave (PDL – see below), this time counts for PFL. In other words, you are not required to wait an additional seven days before receiving compensation.

PFL can run concurrently with CFRA (see below) and FML. PFL does not provide job protection or return rights.

For details regarding California PFL, including applying for benefits, you must contact the Employment Development Department (EDD) directly at 1-877-238-4373 or visit

For details regarding California SDI, including applying for benefits, you should contact the Employment Development Department (EDD) directly:

In addition to the California State Disability State Insurance and California Paid Family Leave described above, you may also be eligible for the following:

California Pregnancy Disability Leave (PDL)

California Pregnancy Disability Leave (PDL) provides up to four (4) months of disability leave if you are disabled due to pregnancy, childbirth, or a related medical condition and physically unable to work due to the pregnancy or pregnancy-related condition. This includes time off needed for prenatal care, severe morning sickness, doctor-ordered bed rest, childbirth, recovery from childbirth, and any related medical condition. In general, you must provide at least thirty (30) days notice before taking PDL. This leave runs concurrent with the coverage provided under the Company’s short-term disability policy and with FML. PDL may be taken on an intermittent basis (i.e., in small increments but not more than four (4) months in the aggregate).

California Family Rights Act (CFRA)

CFRA is an additional 12 weeks of unpaid leave to allow you to bond with your baby. Like the federal FML, CFRA also provides job/benefit protection and return rights. It begins once you are no longer on disability following the birth of your child. Depending on the length of your disability (which is covered under FML), the CFRA may run concurrently with the remaining portion of your FML which is used for bonding time with your baby. Note – depending upon your Operating Company’s individual parental leave policy, you may be eligible to receive salary continuation during the “baby bonding” period of your FML leave and/or CFRA leave.

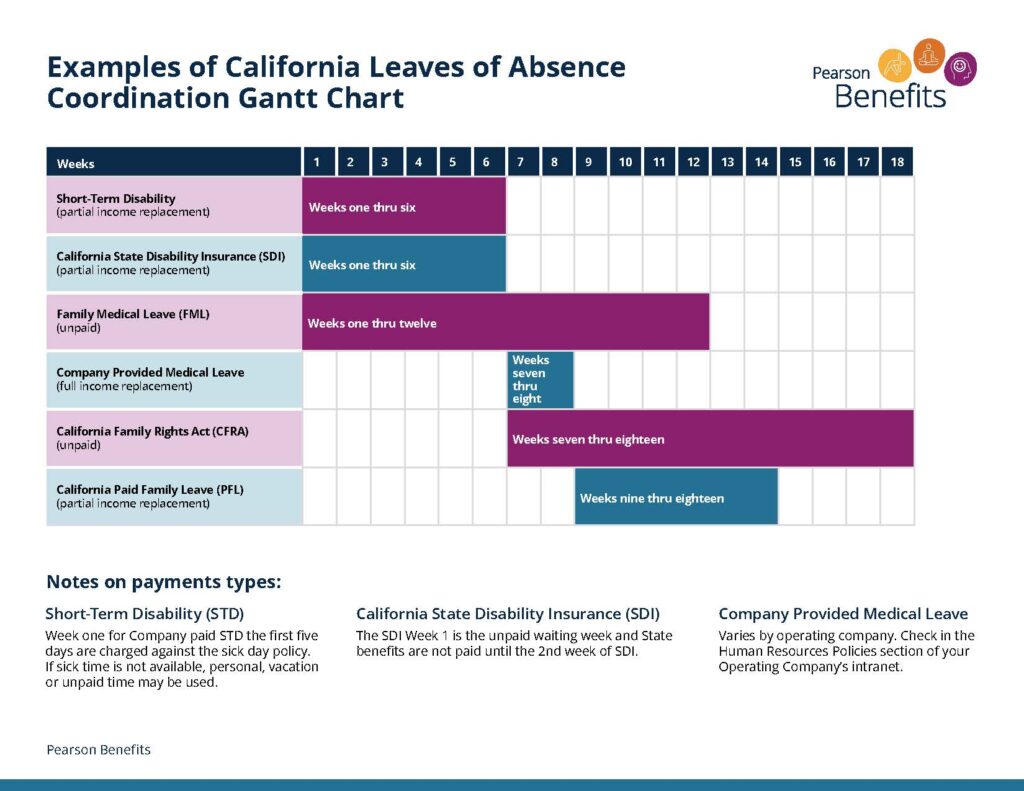

Below is an example of a typical (postpartum) maternity leave. It outlines how the Federal, State of California provisions and Company programs coordinate during pregnancy disability leaves. If you have questions about how these various leaves coordinate with Company policies, please contact your leave coordinator.

Note: California Pregnancy Disability Leave (PDL) may also be applicable. After exhausting Disability payments (STD + SDI) you may be eligible to continue your pay by using unused vacation and personal days.

For a visual representation of the how the different types of leaves start, end, and overlap, download the Examples of CA Leave and Benefit Coordination Gantt Chart (PDF, 87 KB).

Short-Term Disability (STD)

Payment type:

partial income replacement

Weeks applicable:

one thru six

Note: week one for Company paid STD the first five days are charged against the sick day policy. If sick time is not available, personal, vacation or unpaid time may be used.

California State Disability Insurance (SDI)

Payment type:

partial income replacement

Weeks applicable:

one thru six

Note: The SDI week one is the unpaid waiting week and State benefits are not paid until the second week of SDI.

Family Medical Leave (FML)

Payment type:

unpaid

Weeks applicable:

Weeks one thru twelve

Company Provided Medical Leave

Payment type:

full income replacement

Weeks applicable:

Weeks seven thru eight

Note: Varies by operating company. Check in the Human Resources Policies section of your Operating Company’s intranet.

California Family Rights Act (CFRA)

Payment type:

unpaid

Weeks applicable:

seven thru eighteen

California Paid Family Leave (PFL)

Payment type:

partial income replacement

Weeks applicable:

weeks nine thru eighteen